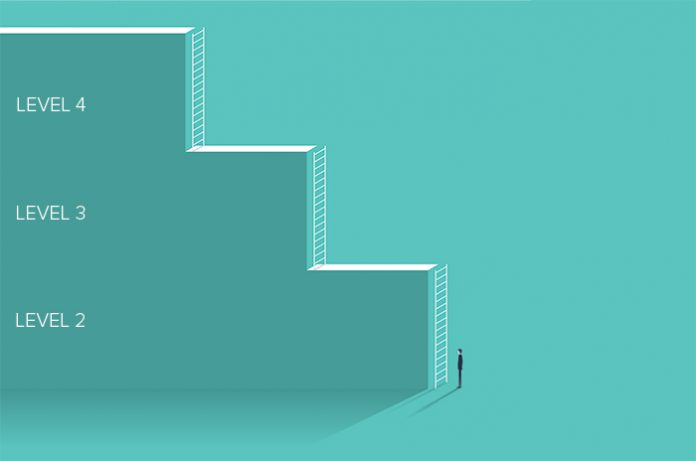

You did it! You’ve completed the Advanced Diploma in Accounting! First of all, congratulations. But you may be asking yourself, “what now?” For some, the Advanced Diploma represents the ideal way to enter the accounting industry. Others, however, may wish to continue their education with a view to progressing up the professional ladder. Enter AAT’s highest level of certification: the Professional Diploma in Accounting.

The Level 4 qualification is a must for those aspiring to reach senior accounting positions. There are also additional benefits to obtaining the Level 4 qualification that we’ll talk about later.

What Level of Knowledge Do I Need to Study the Professional Diploma in Accounting?

Like the Foundation Certificate and the Advanced Diploma, the Professional Diploma in Accounting can be accessed in several ways. If you’ve completed the Advanced Diploma in Accounting, you’ll be able to access the level 4 qualification from one of the many AAT education providers around the UK, or you can opt to complete the course via a distance learning programme. Alternatively, if you’ve been working in an advanced level accounting position for some time, you may wish to formalise your knowledge with a globally recognised qualification. Take the AAT Skillcheck test to find out which AAT level fits your knowledge. You can speak with an Aspiring Accountants adviser to discuss what your test results mean.

What Will I Learn?

The full course specification can be found on our AAT Level 4 guide. However, you can expect to cover the following topics:

- Financial Statements for Limited Companies

- Management Accounting: Budgeting

- Management Accounting: Decision and Control

- Accounting Systems and Controls

- Business Tax

- Personal Tax

- Credit Management

- External Auditing

- Cash and Treasury Management

How Long Will the Course Take?

The course usually takes around a year to complete. Students learning at an accelerated pace may be able to finish in as little as nine months.

How Much Does the Course Cost?

Course fees are decided by each AAT provider, so be sure to do your research before applying. The price can range from £1,000 to £3,000.

After I Graduate?

After you’ve graduated from the Professional Diploma in Accounting, you’ll have plenty of professional and academic options. Straight off the bat, graduates will gain Affiliate AAT membership. AAT Affiliate membership boosts earning potential and is the first step to gaining the various other AAT memberships.

Thanks to the quality of the AAT course, Level 4 graduates will also be able to bypass some of the steps necessary to become a chartered accountant. Those looking to enter the working world will have numerous options, including:

- VAT Accountant

- Tax Supervisor

- Senior Bookkeeper

- Payments and Billings Manager

These roles are in addition to all those available at Levels 2 and 3.

Once you begin your career in accounting, you’ll be well on your way to achieving full MAAT status. Read more about the benefits of the various AAT memberships here.

What Next?

Interested in gaining AAT’s highest certificate of accounting proficiency? Get in touch with the Aspiring Accountants advisory team today to discuss your options.